Explore innovative financial strategies to grow your savings while minimizing tax liabilities.

As we approach the final stretch of 2023, it’s time to consider tax planning. One highly intriguing and popular avenue, according to Ticy City, is investing in tax-deductible funds. This not only provides tax benefits but also opens doors to potential future returns. Today, Ticy City introduces three funds – RMF, SSF, and ThaiESG – offering a diverse range to cater to individual preferences.

RMF (Retirement Mutual Fund):

RMF is a mutual fund designed for retirement planning. Investors can allocate funds into various securities such as stocks, bonds, real estate mutual funds, and infrastructure funds. Managed by professional fund managers, RMF requires annual contributions until the age of 55, with a minimum holding period of 5 years. Early withdrawals before age 55 incur additional taxes, making it a strategic long-term investment.

SSF (Super Savings Fund):

SSF focuses on promoting long-term savings for future goals, such as buying a house, a car, or getting married. Unlike RMF, SSF doesn’t require annual contributions and allows holding for a minimum of 5 years, with full benefits realized after 10 years. Early withdrawals within the first 5 years attract additional taxes on earnings.

ThaiESG (Thailand ESG Fund):

ThaiESG is an ESG (Environmental, Social, Governance) fund that extends tax benefits beyond RMF and SSF. Launched in December 2023, it aims to provide alternative options for long-term savings and investments. In addition to individual financial growth, ThaiESG contributes to the sustainable development of Thailand. Investors can enjoy tax deductions for the 2023 fiscal year by purchasing the fund before December 28, 2023.

As the year concludes, take advantage of these tax-efficient investment opportunities to secure your financial future while contributing to the sustainable growth of the nation.

Comparing ThaiESG, SSF, and RMF Funds

| ThaiESG | SSF | RMF | |

| Maximize Your Deductions | Not Exceeding 30% of Income | Not Exceeding 30% of Income | Not Exceeding 30% of Income |

| Maximum Amount Eligible for Deduction | 100,000 THB | 200,000 THB, when combined with other retirement funds, must not exceed 500,000 Baht. | 500,000 Baht, when combined with other retirement funds, must not exceed 500,000 Baht. |

| Investment Period | Less than 8 years | Not more than 10 Years | Not less than 5 years; redeemable at age 55 or older. |

| Purchase Condition | No Specific Investment Amount | No Specific Investment Amount | No specified investment amount. Upon purchase, consecutive annual investments are required or can be done biennially. |

| Invested Assets | Stock and Depth Securities with SET ESG Rating | All Type of Assets | All Type of Assets |

| Year Eligible | 2024-2042 | 2023-2041 | 2023 onward |

Many tax planners advise that, before delving into tax-deductible funds, the first thing to understand is your annual net income and the corresponding tax rate. This knowledge is crucial for judiciously allocating funds into tax-deductible investment schemes.

Personal Income Tax Rates

| Net Income (in Thai Baht) | Tax Rate | Tax Amount | Accumulated Amount |

| 1-150,000 | 0 | 0 | 0 |

| 150,001-300,000 | 5% | 7,500 | 7,500 |

| 300,001-500,000 | 10% | 20,000 | 27,500 |

| 500,001-750,000 | 15% | 37,500 | 65,000 |

| 750,001-1,000,000 | 20% | 50,000 | 115.000 |

| 1,000,001-2,000,000 | 25% | 250,000 | 365,000 |

| 2,000,001-5,000,000 | 30% | 900,000 | 1,265,000 |

| 5,000,001 + | 35% |

Investment Guidance from Krungsri The COACH: Choosing the Right Tax-Deductible Fund for Your Goals

When it comes to the investment journey, Krungsri The COACH provides valuable advice. Before diving into any tax-deductible funds, the first consideration should be understanding your own needs and necessities. Assess your financial flexibility and, if resources are limited, prioritize your investment goals. This decision should be aligned with your investment horizon.

For those aiming for long-term savings over approximately 10 years, funds like ThaiESG and SSF are recommended. These funds allow unit redemptions after 8 or 10 years without waiting until the age of 55, similar to RMF. However, if the goal is to prepare for retirement, RMF is a preferable choice. In addition to tax benefits, RMF serves as a gradual savings tool for retirement, with continuous annual (or biennial) contributions increasing the chances of long-term capital growth.

For investors aged 50 and above, choosing RMF involves a shorter investment period. After just 5 years, units can be redeemed without waiting for the full 8 or 10 years, as required by ThaiESG and SSF. The choice between these funds also involves assessing the level of risk tolerance. Investors with low to moderate risk tolerance are advised to diversify into low to moderate-risk assets, such as bonds, deposits, or debt securities. On the other hand, high-risk tolerance investors can consider allocating funds to SSF or RMF with a higher proportion of high-risk assets, such as Thai stocks, foreign stocks, or gold.

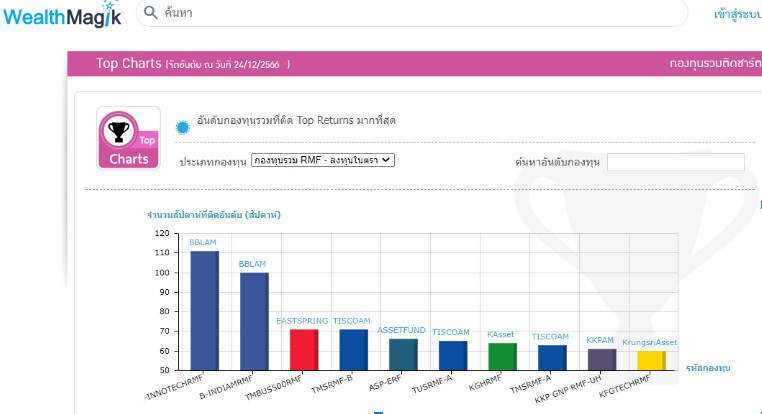

Ticy City simplifies the decision-making process by providing a list of the top 10 funds with the highest returns. Interested investors can explore the top-performing RMF or SSF funds at the following link: Top Performing Funds.

For instance, a sample RMF mutual fund investing in equities lists the top 10 funds with the highest returns.

And if you seek assistance in screening funds based on past performance, you can utilize Morningstar Ratings. These ratings are calculated by assessing the historical performance of funds, and they exclusively rank funds with a track record of more than 3 years. Ratings are assigned in stars, with a maximum of 5 stars. Investors can use these ratings as a simple criterion for fund selection.

Morningstar Ratings are compiled by Morningstar, an American financial services company operating since 1984. They specialize in researching investment data and providing investment management services.

As an example, you can explore the Morningstar Rating for RMF funds investing in equities, allowing you to view both short-term and long-term returns. Visit the link: Morningstar RMF Equity Funds

Ticy City hopes that this preliminary information and guidance will be beneficial to those seeking to invest in tax-deductible funds. For more in-depth information, it is advisable to consult or seek additional advice from financial and investment experts at banks and fund management companies.

Leave feedback about this